How to maximize your retirement income with Social Security

Two common ways to maximize retirement income involve paying less in taxes and getting more from your Social Security benefits. Social Security, the government pension program and social safety net established in 1936 during the Great Depression, is the primary source of retirement income for many retired workers. For some, sadly, it is the only source, which explains in part why we find so many seniors continuing to work because they have to in what should be their retirement years.

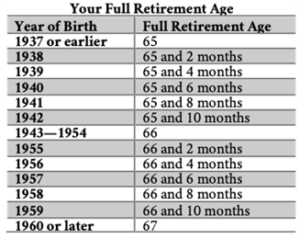

The full retirement benefit for which you are entitled—based on the involuntary contributions you made to the Social Security Trust Fund through FICA withholding from your regular paycheck—is due at full retirement age (FRA). You can track the amount of your full benefit by establishing a personal profile on the Social Security website.

Image Source: https://www.ssa.gov/planners/retire/retirechart.html

A worker who qualifies for benefits can begin taking them as early as age sixty-two. But as many people know, you can receive a reduced benefit—a reduction averaging about 6 percent a year—for each year you receive benefits before your FRA. Equally important, this reduced benefit is what you can receive for the rest of your life. Your monthly benefit can increase only through cost-of-living adjustments (COLAs) that may or may not be made annually, depending on the rise of inflation.

Now let’s consider more positive news on the subject of when to begin taking benefits. You can receive an enhanced benefit if you choose to delay taking benefits until after FRA. Your monthly benefit can increase at a rate of 8 percent for every year you delay taking benefits between FRA and age seventy, the point at which these delayed retirement credits end.

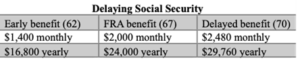

The difference between a benefit taken early vs at full retirement age or later

Let’s plug in some numbers to show the difference in a benefit taken early when compared to one taken at FRA or even later. The person in this example is scheduled to receive a full monthly lifetime benefit of $2,000 at age sixty-seven, his FRA. If he first begins taking benefits at the earliest possible age (sixty-two), the Social Security Administration says his lifetime monthly benefit can be reduced by 30 percent (an average of 6 percent per year over five years) to $1,400. However, if this same person delays taking Social Security until age seventy, the monthly benefit grows by 24 percent (three years times 8 percent yearly) and becomes a $2,480 per month lifetime benefit. Consider what those three different benefit levels might mean over the course of a single year.

The monthly payment established when first taking benefits—whether at FRA or on an “early” or “delayed” basis—also sets the standard for any spousal or survivor benefit. A spousal benefit is available at the FRA of a spouse who lacks a qualifying work history—a stay-home parent, for instance, who works extremely hard but without employment compensation. This benefit can be up to half of the “working” spouse’s benefit. A survivor benefit (which is available as early as age sixty) for a widow or widower is the larger of the two benefits available during the lifetime of a couple. The Social Security Administration eliminates the smaller of those two benefits following a spouse’s death.

When is the best time to begin taking retirement benefits?

Only you can answer that highly individualized question. Still, the assistance of a financial advisor with a solid knowledge of Social Security issues as well as a comprehensive view of your broad financial picture can be very helpful in making that decision. But whether or not you seek professional advice, everyone should understand two simple “rules of the game.”

- Rule 1: The longer you wait to take benefits, the more you can receive in a monthly benefit.

- Rule 2: The longer you live, the more you can receive in total lifetime benefits.

Now, who knows how long they can live? Answer: Nobody. You can, however, make at least an educated guess based on the longevity history of your family. This is something you know better than the actuaries who establish mortality tables. Your decision on whether to take benefits early, at FRA, or on a delayed basis might well depend on that knowledge. Other circumstances also come into play.

Maybe you’ve worked as hard as you can for as long as you can and need an “early retirement” that depends on a Social Security benefit for income. The Social Security Administration tells us that more Americans do take an early benefit, many at age sixty-two. These people do so knowing they can receive a smaller monthly benefit, but they also know they can ultimately receive more checks than do those who wait until a later age to begin taking benefits.

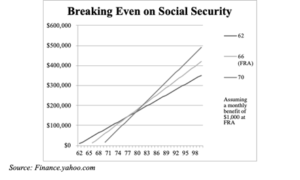

Other people, however, can afford to wait for that later age. Maybe they enjoy full-time employment and don’t want to retire until FRA or later. Or, maybe they have enough income in retirement that they don’t immediately need Social Security and can afford to let their benefit grow until it stops growing at age seventy. Such people can receive fewer total payments than those who take benefits earlier, but they can receive a larger benefit each month. Here is where the issue of longevity enters the picture.

There is a “break-even” point somewhere around age seventy-nine or eighty, at which the total amount of Social Security benefits paid to persons taking “early” benefits, FRA benefits, or “enhanced” benefits becomes equal (see the following chart). Those taking early benefits come out ahead if they don’t live to this break-even point. But those living beyond age eighty who delayed taking benefits until FRA or later come out as the winner in the total benefits derby.

Which option is right for you?

By using software that examines your entire financial picture as well as your family longevity, a financial advisor can help you make a more informed choice for this decision that can affect the rest of your life. Are you looking to retire in the next five years? Contact the Shunkwiler team of financial planning experts based in Omaha and Lincoln, Nebraska to help you maximize your retirement income:

Not associated with or endorsed by the Social Security Administration or any other government agency.

Maximizing your Social Security Benefits assumes foreknowledge of your date of death. If as an example you wait to claim a higher monthly benefit amount but predecease your average life expectancy, it would have been better to claim your benefits at an earlier age with reduced benefits.